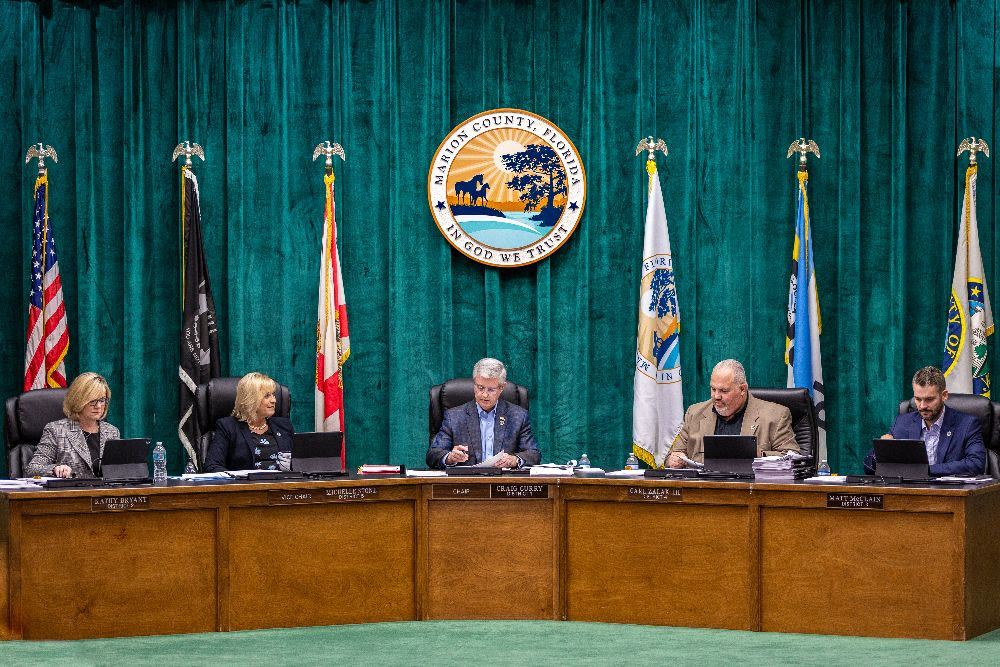

The Marion County Board of County Commissioners has adopted the final budget for next fiscal year, which totals $1.4 billion and runs from October 1, 2023 to September 30, 2024.

The total adopted budget ($1,408,558,754) includes the countywide budget of just under $999 million and the budgets of non-countywide entities ($409.6 million).

A final budget public hearing was held on Thursday, September 21, and the commissioners maintained a countywide millage rate of 4.29 mills. This millage rate equates to $4.29 for each $1,000 of taxable property value.

The countywide millage rate funds the county’s general fund, which includes:

- Board of County Commissioners departments including Animal Services, Fleet Management, Parks and Recreation, Public Library System, Veterans Services, and others. The following departments are not included: Solid Waste, Building Safety, Utilities, Visitors and Convention Bureau, Airport, and the Office of the County Engineer (transportation/roads).

- Emergency medical transport provided by Marion County Fire Rescue.

- Marion County Sheriff’s Office jail administration and emergency operations.

- Constitutional offices (Clerk of the Court and Comptroller, Supervisor of Elections, Property Appraiser, and Tax Collector).

- Courts and criminal justice (court administration technology, Guardian Ad Litem technology, public defender technology, and the drug and teen courts).

- Reserves for natural disasters and emergencies.

- Partner agencies (The Centers, Inc., Marion Senior Services/Transit, Heart of Florida Health Center, Early Learning Coalition, and others).

The millage rate also funds the county’s fine and forfeiture program (overseen by the Marion County Sheriff’s Office, with some portions overseen by the Clerk of the Court and State Attorney’s Office), as well as the Florida Department of Health in Marion County (a state-county funding partnership).

The 2023-2024 millage rate for the Municipal Service Taxing Unit (MSTU) for law enforcement will remain at 3.72 mills. This MSTU is applied to properties in the unincorporated areas of the county that receive sheriff patrol services.

All other non-countywide millage rates will remain at their current levels, including the MSTUs for Hills of Ocala, Marion Oaks, Rainbow Lakes Estates, and Silver Springs Shores, as well as the MSTU for Fire, Rescue, and EMS, which is 1.11.

The special assessment rates for solid waste and stormwater also remained at the same levels.

For more information, or to view the countywide budget documents, visit the Marion County Clerk of Court and Comptroller website.